Card as a Service API

Overview

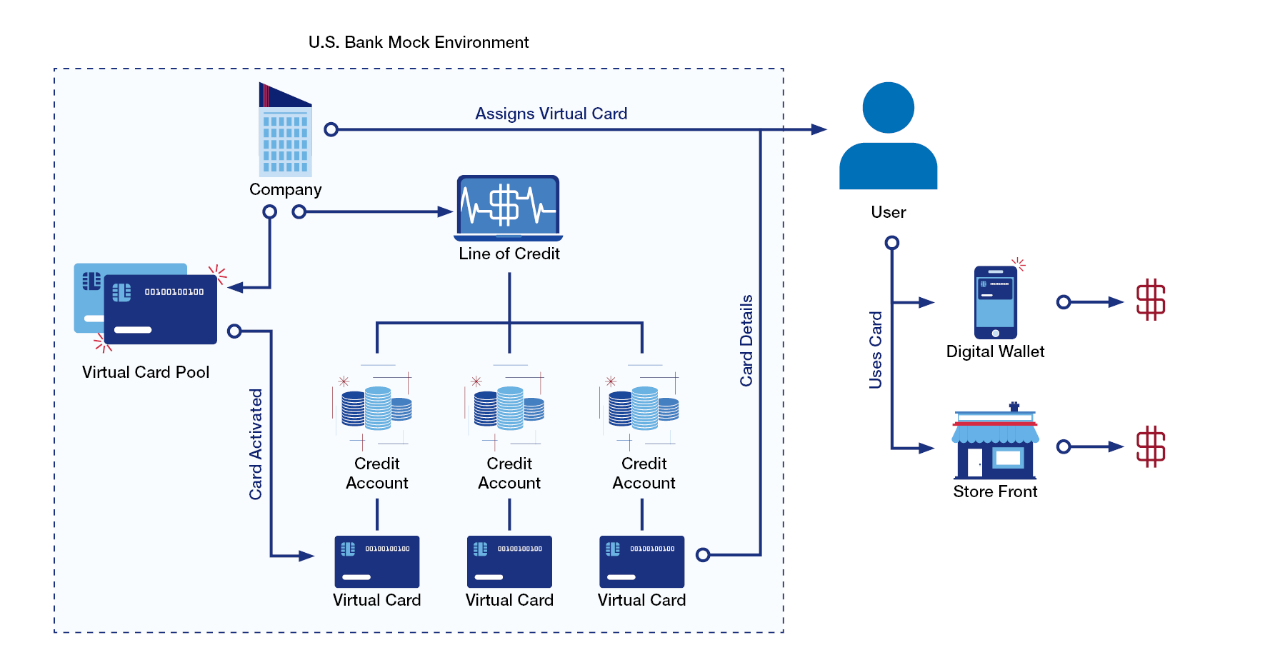

The CaaS API allows a company administrator to manage its portfolio of virtual cards including the ability to assign cards and review card usage.

Features

These APIs enable users to create, provision, distribute and manage the virtual payment cards that are made available through the CaaS technology.

With these APIs, users of CaaS can:

- Create a Virtual Card

- Provision a Virtual Card to a specific User

- Check the available balance on a card after it has been created

- Retrieve detailed information about the cards that have been provisioned and the details on individual cards

- Retrieve the security codes for individual cards

- Close and cancel the virtual cards

- Payoff the virtual cards

Using these APIs and features, in conjunction with the other available APIs hosted for the hackathon, a participating team can emulate the technology that will be available to companies and individuals looking to build CaaS into their technology, as well as managing the funds that are made available through the credit program that will sit behind the technology.

Workflow

Use cases

Customer access to payment processing.

George is a developer who has been tasked with identifying a solution to improve the way that his company is able to create and distribute payment options for their customers within their own technology. His company is looking to create a more comprehensive payment solution set within their platform to accompany their existing features that let customers process payments and send invoices. They have been able to improve their customers' experience with their software by investing in process integration through APIs, and they are looking to continue to provide their customers with amazing features!

Integrate software into business processes.

Stephanie is a product manager who has been tasked with evaluating feedback from customers on desired product features that align with her company's current strategy to reduce churn and increase overall net revenue retention. She is looking at features that not only delight their customers while not requiring a lot of development work on her team, but she is focused on choosing roadmap items that further integrate her software into customers' business processes - making her company more sticky. She has determined that the CaaS product checks both of those boxes, and she is now working with her team to build the available CaaS APIs into her technology and begin marketing the upcoming features to her customers.

Extend payment options.

Carl is a VP of Customer Experience for a company that is trying to find solutions to one of their customers’ most common complaints – expense reimbursement. Many of the services that they provide require customers to incur personal expenses. They want to move toward a more controllable method of delivering payment options for their customers that removes some of the friction involved with using these services. He has found the CaaS solution to be compelling because it extends a payment option to customers that does not require them to float any expense that would be reimbursed, has the controls that he is familiar with for typical corporate credit and allows his company to earn rebates through the credit program that they otherwise would not earn.