Version: 1.0

Money Movement API

Simulate a variety of financial transactions in and out of different synthetic accounts to emulate real customer behavior.

Overview

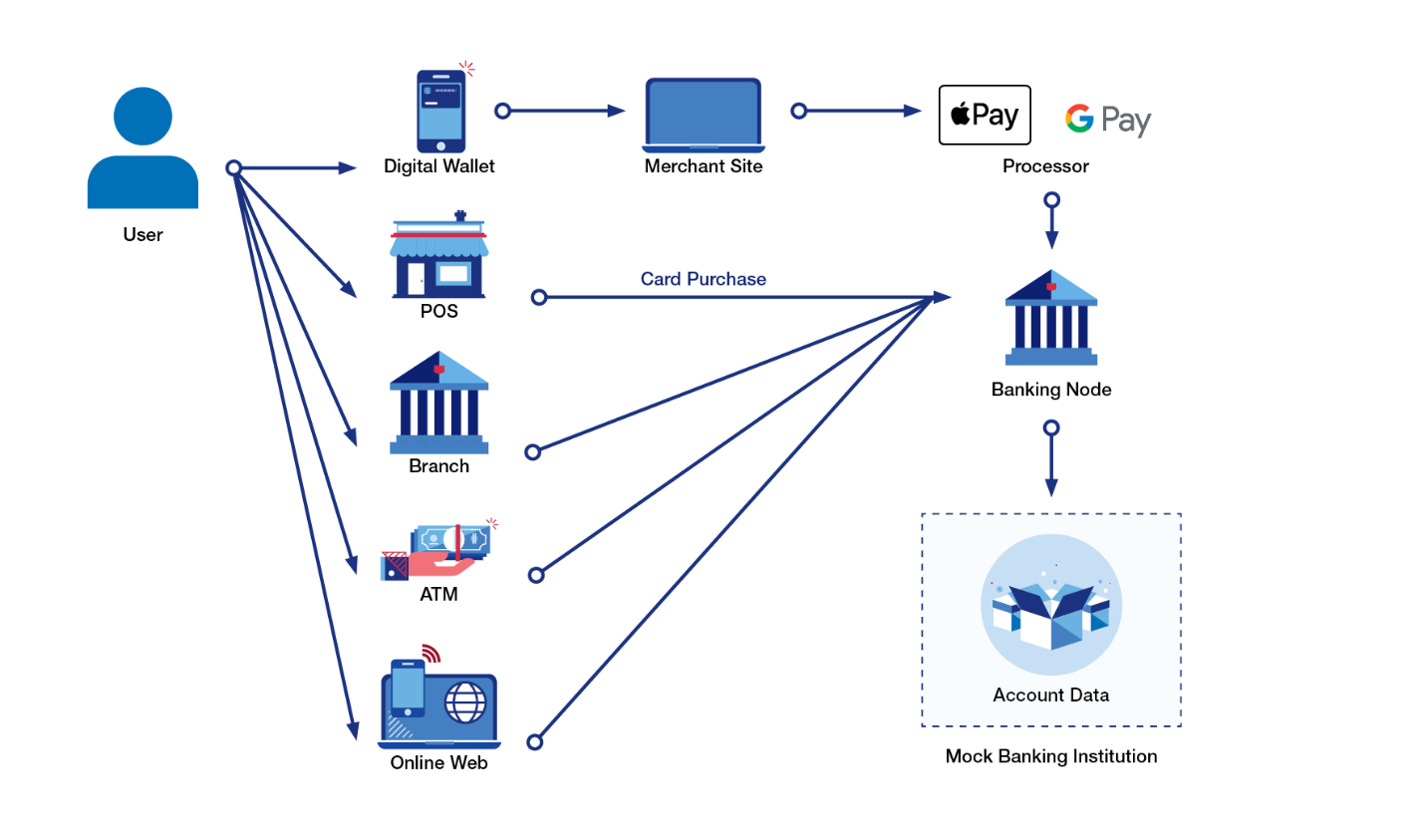

The Money Movement API suite allows one to perform a variety of financial transactions into and out of different synthetic accounts to emulate real customer behavior: paying bills, depositing checks, purchasing items and more. In general, one will perform these transactions from the perspective of a single customer using the assigned synthetic accounts.

Features

- Emulate a credit card purchase at a point of sale

- Confirm that card information is valid and account is open, and confirm that there is sufficient credit available for purchase

- Return a purchase receipt

- Make a deposit or withdrawal from a direct deposit account

- Emulate different channels (branch, online or check)

- Collect party information

- Make a payment to a credit account (overpayment is not allowed)

- Transfer money from existing DDA account

- Make a funds transfer (internal transfers will contain cross reference identifiers to reconcile payments; external transfers are allowed between different customers)

- Automatically updates the corresponding account balances to reflect the transaction

- Create a unique transaction record that becomes part of the corresponding account's history

Workflow

Use cases

- Set up an auto-payment to deal with recurring bills

- Encourage savings by making periodic deposits based on external behaviors

- Monitor card purchases to identify opportunities to save money

- Build a budgeting application and monitor outgoing expenses

- Build a fraud alert feature that monitors incoming transactions for discrepancies